The Shift in Airline Distribution: Embracing NDC

The airline industry is undergoing a significant transformation with the adoption of New Distribution Capability (NDC). This IATA initiative allows airlines to distribute fares and ancillary services directly to sellers, bypassing traditional Global Distribution Systems (GDS). While NDC offers enhanced flexibility and personalization, it also introduces new challenges in competitive fare analysis.The Pitfall of Relying Solely on GDS Data

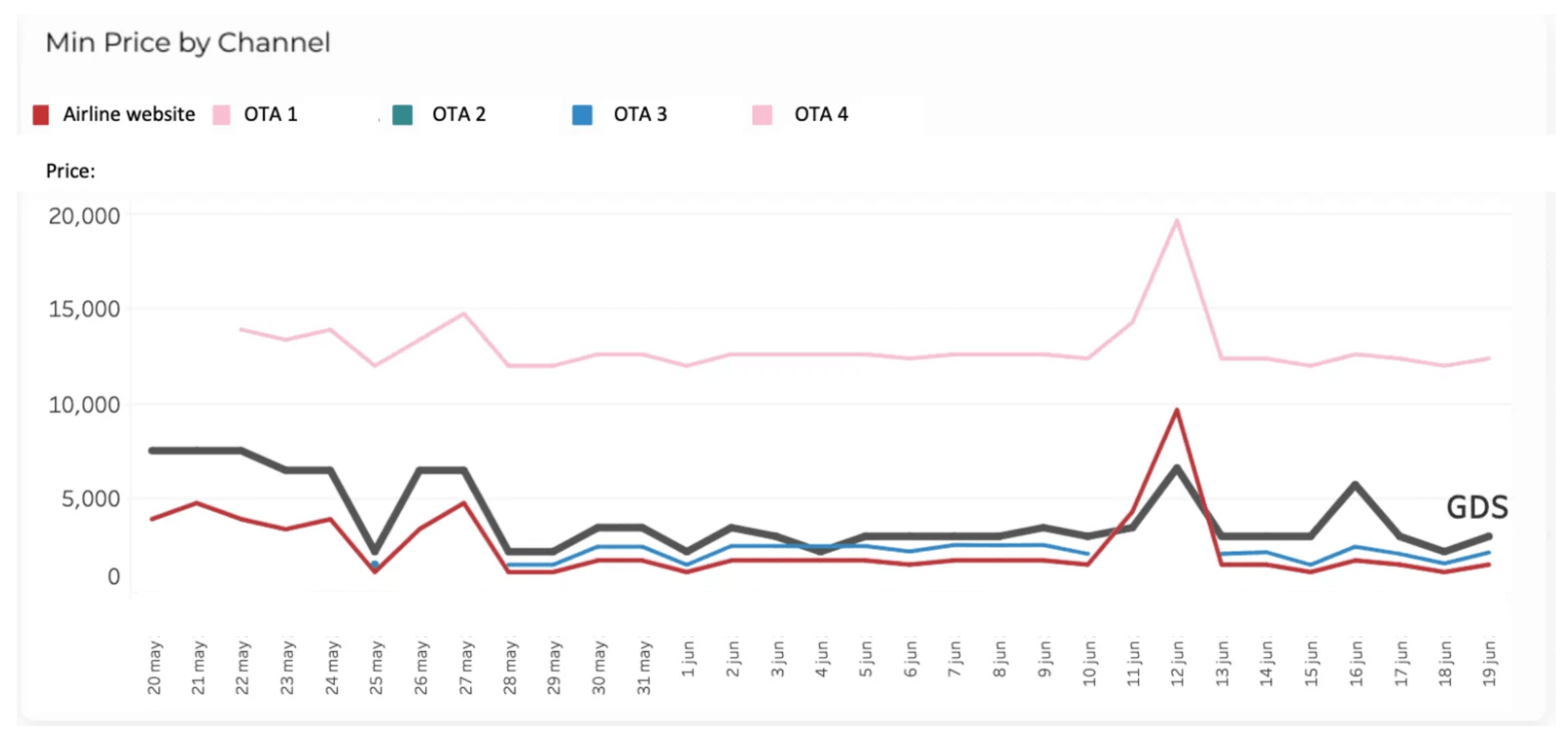

Traditionally, airlines have depended on GDS data for competitive intelligence. However, as highlighted in the FareTrack article “You Don’t Know What You Don’t Know And That Can Hurt You” , this approach can lead to survivorship bias—focusing only on visible data while neglecting critical information from other channels. With NDC enabling direct distribution, a significant portion of fare data may not be captured through GDS alone, resulting in an incomplete market picture.

(source: Faretrack.ai)

The above chart illustrates how GDS data only tells part of the story. Online channels are where the most competitive content resides.

Aggregate Intelligence’s VP Strategy Kris Glabinski says, “You don’t know, what you don’t know, and that can hurt you. Airlines need visibility across multiple channels, and they must analyze, gather and use data from those channels. This requires a re-think in how to approach competitive fare monitoring”

Aggregate Intelligence: Providing Comprehensive Data Solutions

To address these data challenges, Aggregate Intelligence offers advanced data intelligence solutions that aggregate fare data across multiple channels, including GDS, NDC, and direct distribution platforms. By providing a holistic view of the competitive landscape, Aggregate Intelligence empowers airlines to:- Enhance Pricing Strategies: Access to comprehensive data allows for more accurate and dynamic pricing decisions.

- Optimize Revenue Management: A complete market view aids in identifying revenue opportunities and mitigating risks.

- Improve Competitive Positioning: Understanding the full spectrum of market fares enables airlines to position themselves more effectively against competitors.