When it comes to demand indicators for travel and hospitality companies, events stand out as one of the most accurate predictors of out-of-season spikes. Many businesses still rely on gut instinct or “educated guesses” to predict demand fluctuations, often based on previous year experiences. But what happens if the person with prior knowledge leaves? Or if a new major event is announced? Or if an event experiences a significant increase in attendance? These are problems that can be solved relatively simply by having the data intelligence for confident decision-making.

One of the first considerations for many travel and hospitality companies is the event type. In the world of events, they are not all created equally when it comes to the impact they will have on demand. Let’s take a look at a few event categories and how they can potentially impact local demand.

Trade Shows & Conferences

Many trade shows have significant international attendees, as well as many cross-country attendees. If we look at a large trade show, it is not uncommon for over 50% of the audience to be international. What are the impacts this has on demand? Firstly, flights to this location are very likely to see increased levels of demand as exhibitors, organizers, speakers, and attendees all descend on the location. This is an indicator for airlines to firstly look at fares and how to optimize them to match demand and secondly look at capacity. Do they need to open up more seat availability?

Many of these attendees will also be looking for rental cars, particularly at airport locations. So, there will most likely be a spike in demand here. Again, rental car companies can use this indicator as an opportunity to adjust pricing. They can also look at whether they have the correct inventory levels and vehicle categories – for example, are business travelers, who are traveling in groups, more likely to want MPVs that can carry extra luggage? Potentially.

Lastly, the impact on demand for hotel rooms and accommodation is going to be incredibly high. With higher demand comes the opportunity for hoteliers to adjust their rates to maximize revenue or offer additional services such as shuttle buses to the venue or even utilize their facilities to host meetings for event attendees.

Sporting Events

Sporting events have the capacity to draw hundreds of thousands of attendees, depending on the type of sporting event taking place. For example, a Premier League football match might attract 30,000 fans every week – but will this have a significant impact on demand for hotels, flights, rental cars? Potentially not. Most attendees will be local and therefore relatively transient. It is likely they will drive increased demand for rail travel, parking, and food and beverage, though.

If we take an event like the Ryder Cup, which attracted nearly 300,000 attendees during the week it was hosted, it is very likely that this will have a significant impact on flights, hotels, and rental cars. Why? Because the audience is largely international, as are the players, organizers, press, and wider support staff. In this instance, being able to identify the differences in sporting events and audience demographics is critical.

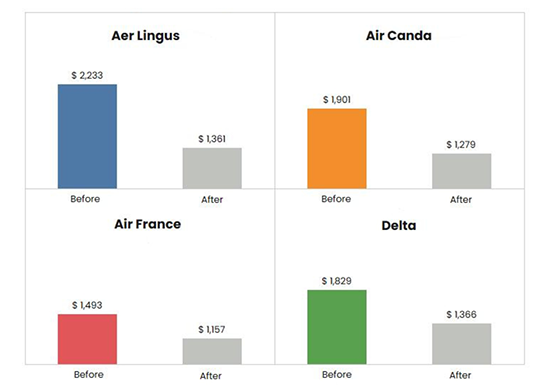

A few months back, we took a look at how the Golf Open affected flight rates. It was clear that the large-scale event, attracting tens of thousands of international attendees to Liverpool, had a profound impact on the average cost the week before and directly after the event.

(average flight rates LAX-MAN the week before and after the 151st Golf Open. Source www.faretrack.ai)

Concerts

With artists such as Ed Sheeran, Beyonce, and Taylor Swift capable of drawing an audience of 100,000+, they are very capable of causing spikes in demand. As an example, recently Ed Sheeran broke the record for attendees at the SoFi Stadium, with 81,000 attendees. On average, hotel prices in the area more than doubled, and most, if not all, were at full capacity. Many hotels in the area ran shuttle buses to the concert, including the cost in the special concert room rates they had created in anticipation of the concert. Many attendees would have traveled to the venue in rental cars – but would this have caused a massive increase in localized demand? Potentially, yes, while many attendees would be leaving home destinations and picking up and dropping off there, there would most likely be an increase in demand for flights as fans traveled cross country, and subsequently an increase in demand for rental cars at local airports.

How do Travel and Hospitality companies need to approach events?

The days of guessing and relying on past experiences should be relics of the past. Data intelligence for events lets us bypass the “finger in the air” approach to offer real, accurate insights for upcoming demand. There also needs to be an emphasis shift from reactivity to proactivity. For many, a spike in demand is only identified with a surge in bookings. This makes companies reactive to change and potentially exposes them to lost revenue opportunities. Effective revenue management strategies need to be proactive, predicting demand before it happens, increasing room rates to match upticks in demand, opening up additional services, and creating tailored promotional packages.

At the heart of proactive demand prediction lies access to accurate data intelligence. Aggregate Intelligence’s Event Data solution provides access to AI-enhanced, fully parsed events data for millions of historical and upcoming events. This data is the cornerstone of many of the world’s leading travel and hospitality companies’ effective demand identification campaigns. If you’re interested in finding out more, get in contact with us today.